Credit Card Processing Made Simple.

We are ready to power your payments.

Both now, and in the future.

✓ Unmatched Heroic Service & Support

✓ Best Value with an Optimised Cost Structure

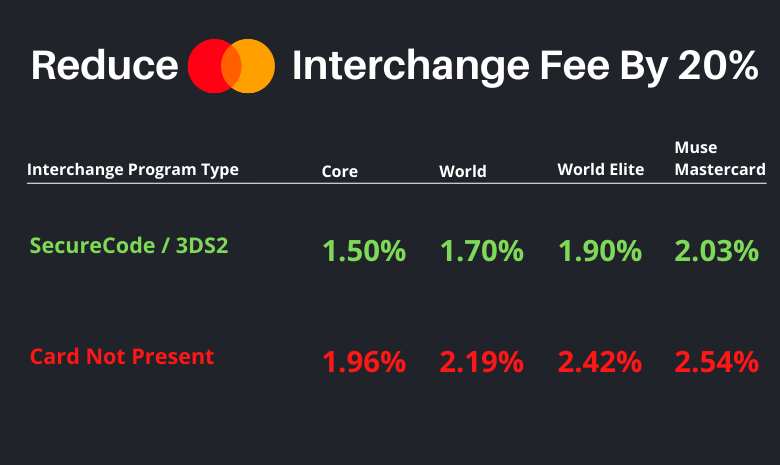

✓ Most Advanced Authentication Solutions

✓ Enhanced Security – PCI Compliance

✓ Reduce Processing Risk & Exposure

✓ Stress Free On-Site Implementation

HAVE US CALL YOU

The Most Advanced Online Payment Solution

Did you know that the average Chargeback due to fraudulent credit card presentment at a Canadian hotel is valued at over $600?

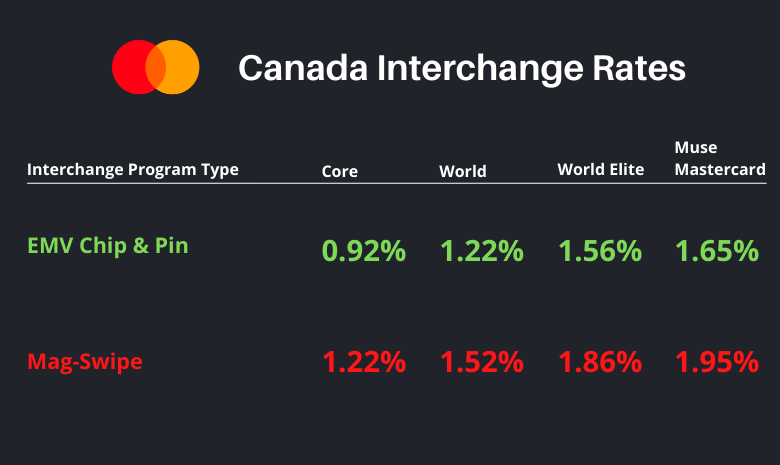

Those hotels that are still accepting payments via mag -swipe (non-EMV Chip & Pin manner) have:

- Zero protection against fraudulent claimed chargebacks

- And can expect to lose thousands $ in unnecessary losses each year

Henceforth, the impact of chargeback losses due to credit card fraud can increase your overall credit card processing costs by up to 0.10% over what you are paying today.

Moreover, if a Canadian merchant processes a Canadian Visa or Mastercard equipped with chip functionality in a “Non-EMV Chip & Pin” manner, the merchant is 100% responsible if the credit card turns out to be fraudulent. No matter which payments platform or payments services are being used.

So, why continue taking the risk?

Let National Payments help you migrate to EMV chip & Pin.

“No other payment processing companies have the expertise and knowledge in credit card processing for Hotels like we do.

We take pride in our ability to provide merchants with the absolute best payment gateway & customer service in the North American Merchant Marketplace. National Payments truly care about its clients, and if there are any issues to be resolved, our team is committed to tackle them quickly and efficiently.”

–

Michael Strong